The 411 on your FAQs

General Awesomeness

CRUNCHR does what it says it will. It’s easier to use and way more affordable. Simplicity, speed and functionality, friends.

Let us be clear, it’s not an accounting platform. It’s much simpler than that.

With its clever ability to capture, search and export, (spreadsheets with receipt photos attached) it’s your golden ticket for tax preparation, or submitting those dreaded expenses claims.

Individuals, businesses, teams, your Nan! It’s designed for everyone!

You don’t even need a laptop or scanners. Just an iPhone that can take a photo or screenshot. Too easy.

Basically, if you submit a tax return (so pretty much every working human), an expense claim or if you need to put in a warranty or insurance claim, you should be using CRUNCHR. What are you waiting for?

You bet! CRUNCHR’s high-tech built-in search engine makes finding a receipt super easy. It Sherlocks through your receipt pics to find keywords, amounts, dates, folders and so on to help you find exactly what you’re looking for. Boom.

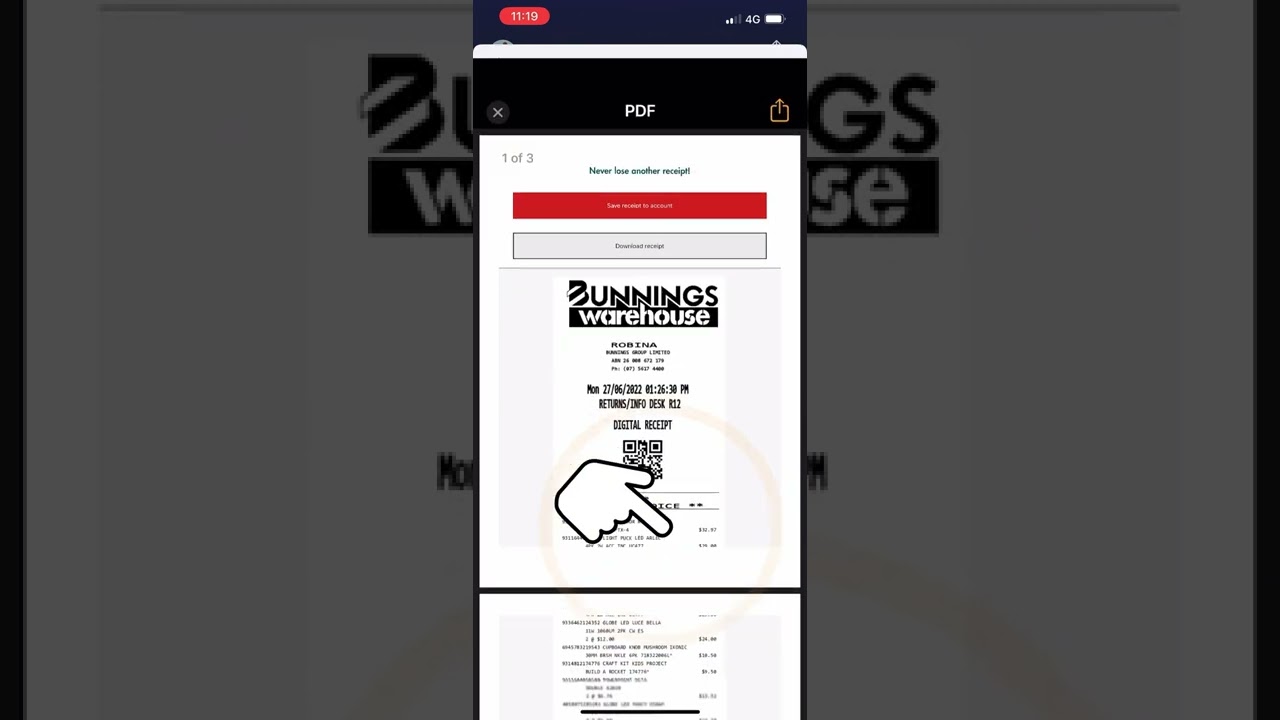

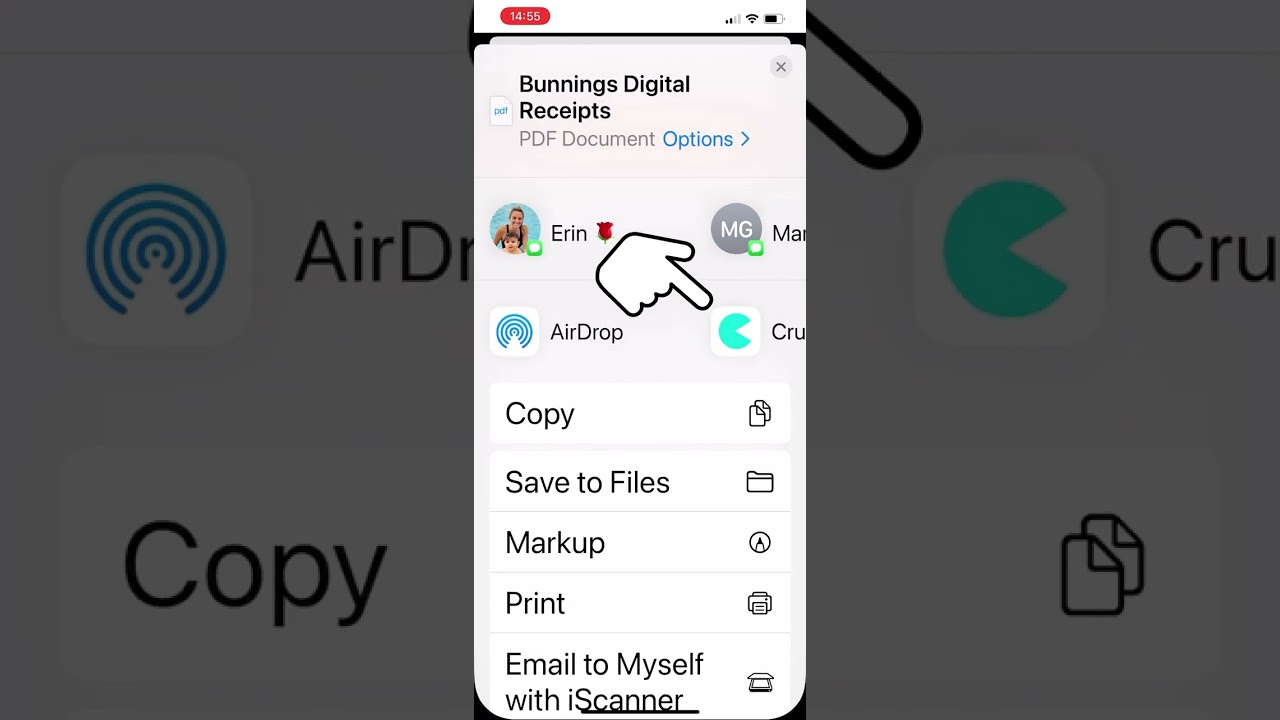

You sure can! E-receipts, PDFs, text messages, emails, photos, files. You name it, Crunchr can store it. Simply take a photo using your camera, snap a screenshot, or directly upload your file to the app.

Of Course. Every time you download a spreadsheet, a file of your receipt images can be included and sent too. So, you can have peace of mind knowing you can store your own copy of your data and receipt images, while we also back it up to our cloud for you.

No worries! CRUNCHR has its own little brain, trained by accountants and powered by A.I smart technology. How cool is that? It’ll suggest a category and folder that matches your receipt information. Users also have the option to change the folder your receipt goes into — CRUNCHR will remember your changes for next time.

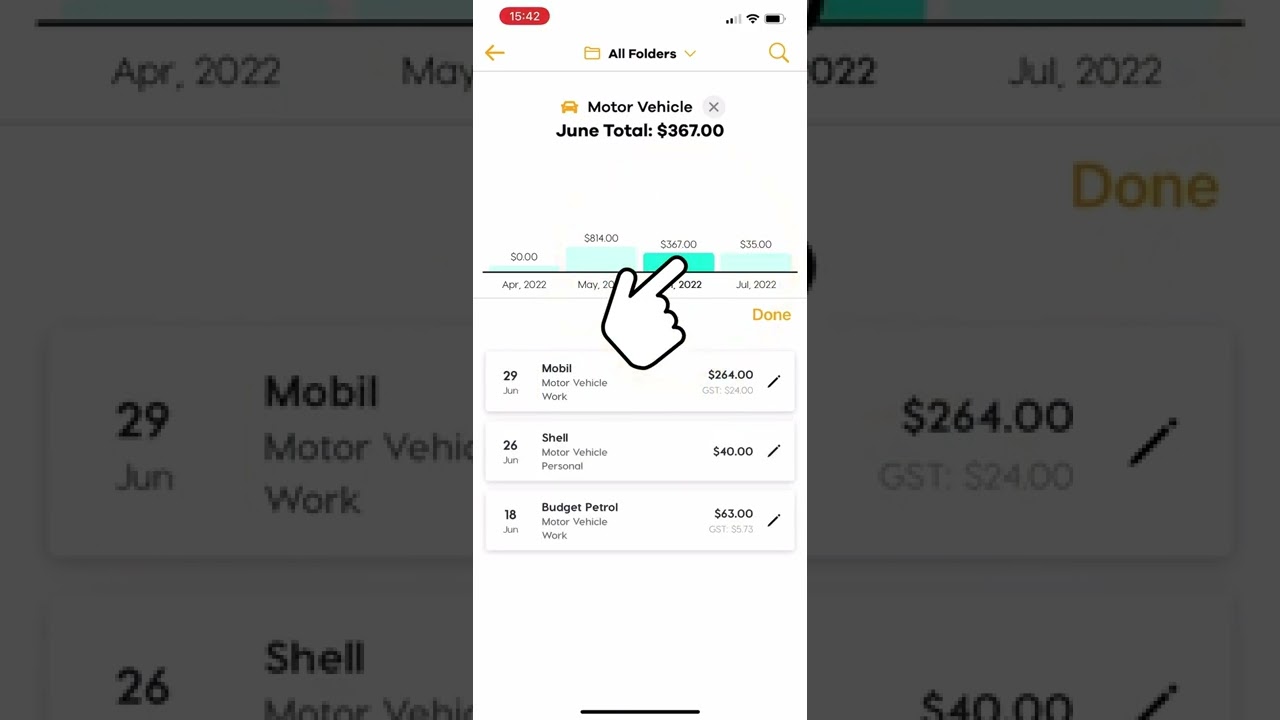

As a matter of fact, it can! CRUNCHR is a great tool to help you keep track of your expenses. The ‘My Spend’ feature even shows you how much you’ve spent on coffee (or any other expense you want to track!) from month to month. Start saving!

Short answer? Yes. Long answer? Still yes. It’ll adjust to your screen size.

CRUNCHR only costs around 0.23 cents a day to save yourself hours of work and stress at tax time. If commitment makes you uncomfortable, we’ve got you. You can give CRUNCHR a try for a whole week, free of charge! Either way, there’s no lock-in contract and you can cancel at any time. You do the math.

Tax bonus?

Keeping digital or paper receipts is a worldwide requirement, and digital receipts are what a CRUNCHR subscription offers you! Meaning it’s generally tax-deductible*.

It doesn’t cost much to live your best life!

*Check with your accountant to confirm your personal circumstance.

Not at all! Store away. You can create as many spreadsheets as you’d like. Unlimited, mate! You can even store expenses and create spreadsheets for particular jobs (any Tradies in the house?). Have an investment portfolio? You can dedicate folders and spreadsheets to that, too!

Security, taxes and spreadsheets. Let’s go!

We may enjoy cracking a joke, but we take our security seriously.

At CRUNCHR, we’re committed to meeting the highest standard of security and privacy protection. Your data is automatically encrypted at the physical layer and stored across the AWS network, using separate environments and databases.

On top of all that? The infrastructure is monitored 24 hours a day, seven days a week by a world-class team of security experts. Win.

Not at all! CRUNCHR backs up all of your data to the AWS cloud. Just download the App on any smartphone and use your secure login to access your data. Sweet!

Yes! So, you can absolutely use CRUNCHR for your expense reporting at tax time. The ATO states, “You’re not required to keep your original paper receipts as long as you’ve kept electronic copies that are a true and clear reproduction of the original.”

Electronic copies are our jam.

*Individuals may have different requirements. Check with your accountant.

They sure do! Just choose your preferred software format when you export your spreadsheet via the CRUNCHR App. If you can’t find your software on the list, don’t worry! Just hit us up to help. We like to make new friends.

Not at all! CRUNCHR’s smart technology can work without the help of the internet. Your data is stored on your smartphone and then automatically backs up to the cloud when you jump back onto the internet.

- It lets you capture and store your receipts all in one place so your expenses are all accounted for come tax time. Sweet.

- You can export your folders into spreadsheets and then export those spreadsheets to your accounting software of choice, if that’s your jam.

- It’s easy. It’s intuitive. And it helps you keep more money in your pocket. Sounds like a win, to us!

- Just remember the 5 S’s. Save. Store. Search. Send. Simple. CRUNCHR’s 5 S’s will save you money with our ‘My Spend’ expense tracking feature while you store, search and send your receipts to stay on top of your tax game. It’s that simple.

Give us a shout if you have any more brain-tickling queries

(preferably CRUNCHR related, but we’re open).

Speak to a member of our awesome CRUNCHR team right here at home in Australia! If we miss you, we promise to get back to you asap.

Get your

Free 7 day trial

No credit card needed.

A free trial that’s actually free. We don’t accept your money until you’ve experienced the life-changing power of Crunchr for yourself.

Try it out risk-free. We think you’ll like it here.

This is going to make my life

so much easier! Love it! – Tina